Millennials and Generation Z are redefining the wellbeing landscape, according to the McKinsey's "Future of Wellness 2024" report. This study, based on surveys of more than 9,000 consumers in China, Germany, the United Kingdom and the United States, reveals that younger generations see wellness as a daily, personalised practice, rather than occasional activities or sporadic purchases.

At In the United States, the wellness market is worth more than $500 billion annually, growing by 4% to 5% each year.. 84% of US consumers consider wellbeing as a "top" or "important" priority, compared to 79% in the UK and 79% in the UK. 94% in China.

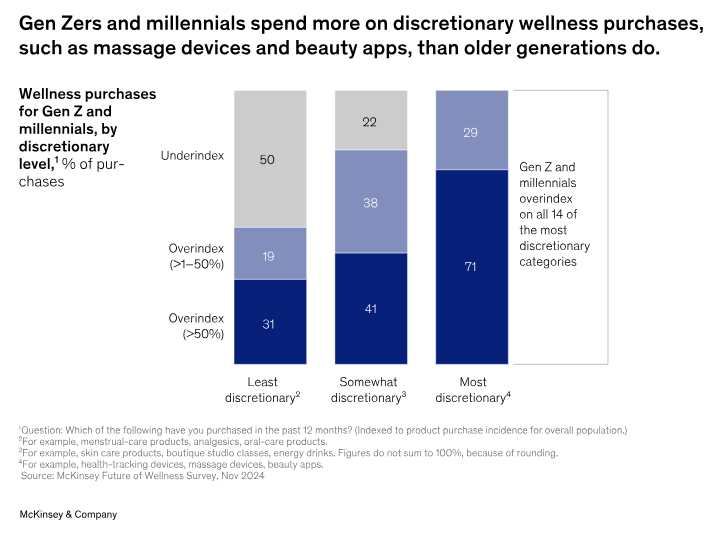

Although members of Generation Z (born between 1997 and 2012) make up just over a third of the adult population in the US (36%), they are responsible for more than 41% of annual welfare spending. On the other hand, consumers aged 58 and older, who represent 35% of the population, only contribute 28% of welfare spending.

Nearly 30% of millennials and members of Generation Z in the US say they prioritise wellbeing much more highly compared to the previous year, compared to 23% of older generations. This trend is attributed to younger generations reporting higher levels of burnout and poorer general health.and the influence of health-related content on social media.

Well-being priorities: sleep, health and appearance

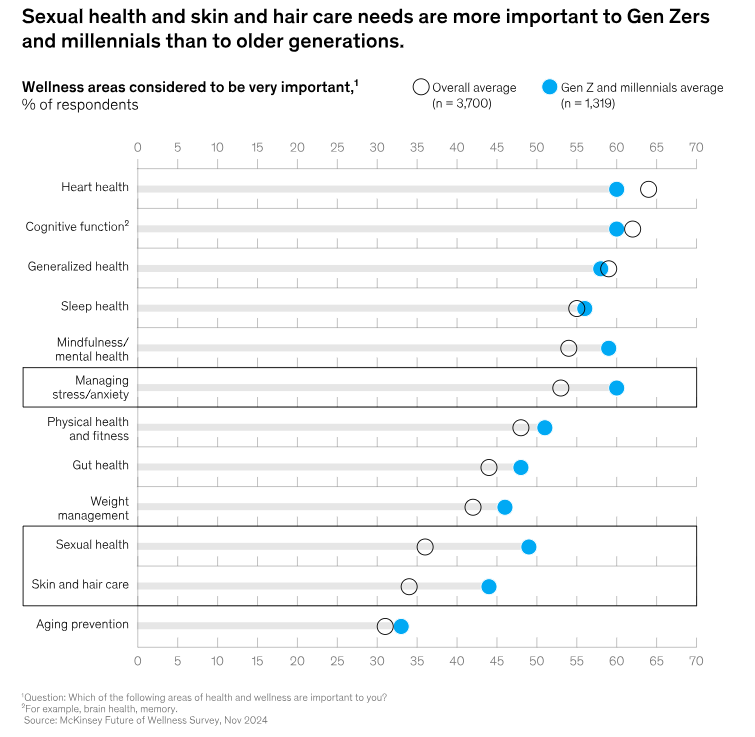

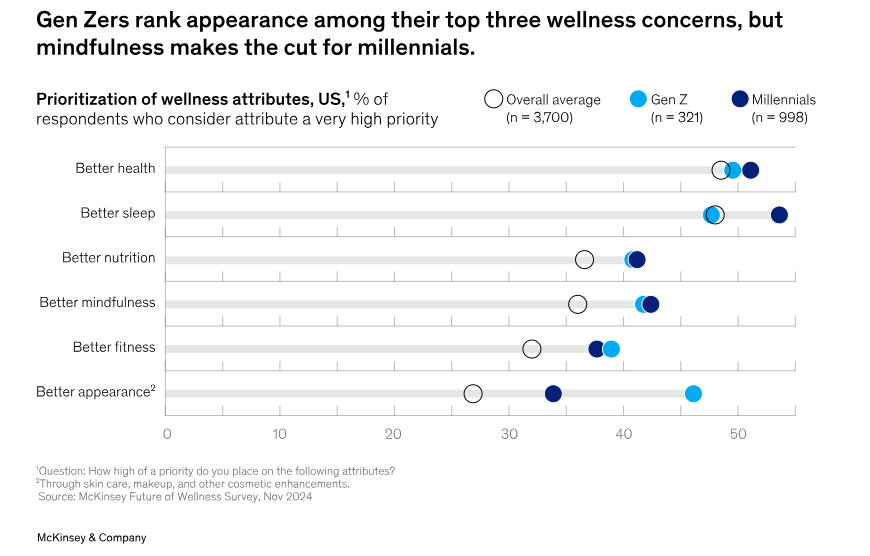

Younger generations rank sleep and health as their top wellbeing priorities, albeit in different orders. Generation Z gives more importance to a "better appearance", while millennials focus more on mindfulness.

Despite the growth of the wellness sector in recent years, consumers of all ages report that they have been unable to find the right products and services. some of their needs are not being met, including issues related to cognitive health, mindfulness, mental health and longevity. Older consumers are also interested in a broader definition of wellbeing, which represents significant opportunities for industry players, especially in advanced markets with ageing populations.

Six growing welfare subcategories

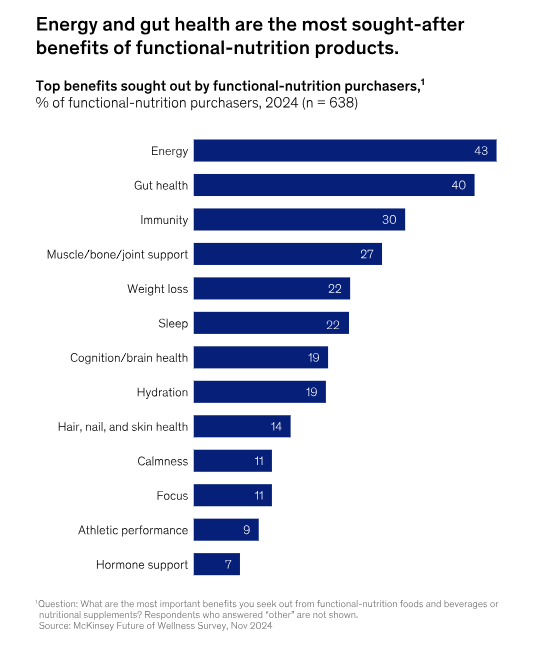

- Functional nutritionThe demand for foods and beverages that offer health benefits is expanding. In the US, UK and Germany, about half of consumers, and two-thirds of millennials and Generation Z, are looking for products that improve energy, gut health, immunity, muscle and bone support.

- BeautyThe intersection between beauty and wellness is increasing. More beauty products include active ingredients with health benefits, and consumers are showing interest in ingestible supplements that promote wellness, such as collagen gummies for skin, hair and nails.

- LongevityLongevity: Demand for longevity-focused products and services continues to grow, with up to 60% of consumers considering healthy ageing a "top" or "very important" priority. Solutions include supplements that claim to slow cellular ageing, epigenetic age testing kits and virtual physiotherapy services.

- Face-to-face experiences and wellness tripsConsumers are purchasing more in-person services in 2024 compared to 2023, including boutique fitness, wellness retreats and intravenous treatments. 56% of US consumers do not consider it a barrier to travel two hours or more for these experiences.

- Weight managementAlthough exercise remains the most common weight management intervention, nutritionist-led programmes, meal plans and prescription weight loss medications are gaining in popularity.

- Mental healthYoung people report worse mental health than older generations, but 42% of millennials and Generation Z in the US are actively seeking solutions. They are adopting behaviours such as buying skincare products, socialising and focusing on sleep hygiene, in contrast to older generations who tend to seek explicit treatments such as therapy.

Five segments of welfare consumers

- Maximalist optimisersMillennials: Primarily millennials and members of Generation Z, they are digital experts who experiment with a wide range of health and wellness products, researching what works for them. They represent approximately 25% of wellness consumers and more than 40% of market spend.(mckinsey.com)

- Confident enthusiastsPrioritise welfare, but are more self-confident than maximalist optimisers. They account for 11% of welfare consumers and 15% of market spending.

- Health traditionalistsOlder consumers who prioritise simplicity and practicality, making up 20% of welfare consumers and 13% of market spending.

- Health fightersThey place a lower priority on health and wellness solutions, accounting for 24% of consumers and 22% of market spending.

- Welfare avoidersLess interested in monitoring their health, they buy only the essentials and are very price sensitive, accounting for 20% of consumers and 10% of spending in the market.

Resilience of the welfare sector

The report also assessed the spa and wellness industry's resilience to a hypothetical economic downturn. Services that consumers said they would cut back on first include subscription meal services (52%), period and fertility tracking apps (49%) and spa and aesthetic treatments (48%).

However, products less likely to be eliminated from spending include menstrual care products (58%), child care products (45%), corrective eyewear (45%), contraceptive products (30%) and supplements (27%).

To access the full report, please visit: McKinsey Future of Wellness 2024(mckinsey.com)