The $1.8 trillion global wellness market is no stranger to fads, such as cold baths, collagen or celery juice, which sometimes lack scientific backing or credibility. Today, consumers are no longer content to simply try out these trends, but demand to know: "Do you want to know: "Do you want to know?What does the science say?

The latest study by McKinsey on the "Future of Welfare"which surveyed more than 5,000 people in China, the UK and the US, looks at the trends that are shaping this sector. This article highlights seven areas within wellness that offer great opportunities for innovation and investment.

The future of well-being based on science and data

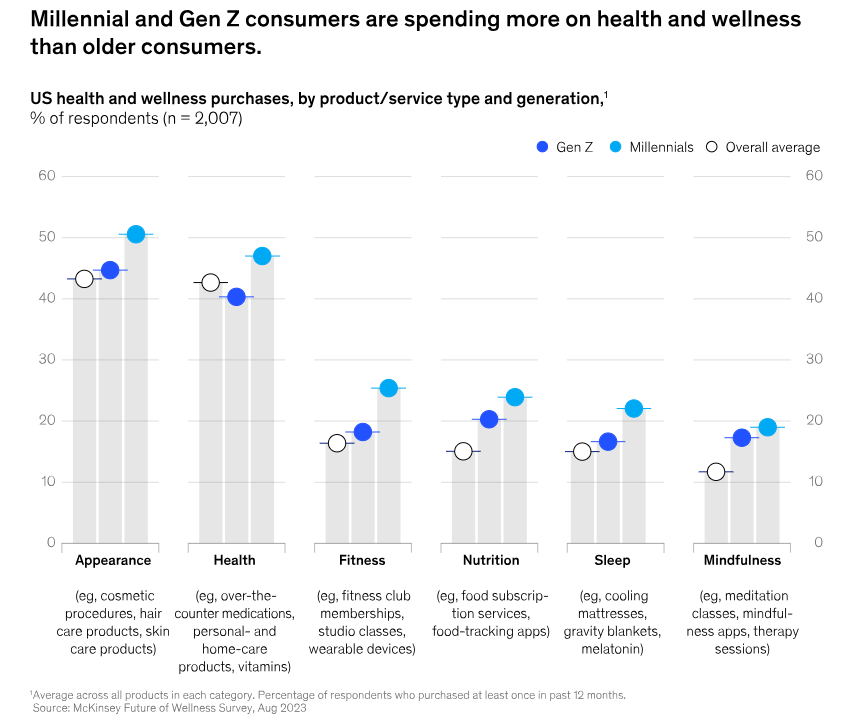

In the US alone, the wellness market is estimated to have reached $480 billion, with annual growth of between 5 and 10%. An estimated 82% of consumers in the US consider wellness an important priority in their daily lives, a similar percentage to the UK (73%) and China (87%). This trend is particularly strong among younger generations, such as millennials and Generation Z, who are purchasing more wellness products and services in areas such as health, sleep, nutrition, fitness, appearance and mindfulness.

Globally, the survey results show a clear expectation: consumers demand health and wellness solutions that are effective and backed by scientific data.

Seven areas of growth in the wellness sector

The study identifies several areas in wellness where consumer interest, technological advances and product innovation are driving expansion:

- Women's health

Traditionally, women's health has been neglected. However, demand for women's health-related products is increasing, especially in areas such as menopause and pregnancy. Despite the growth, the market still does not fully meet the needs, especially in segments such as menopause. - Healthy ageing

Interest in products that promote healthy ageing is on the rise, driven by a focus on preventive medicine and technological advances in healthcare, such as telemedicine. More than 60% of respondents consider it very important to purchase products that help in this process. - Weight control

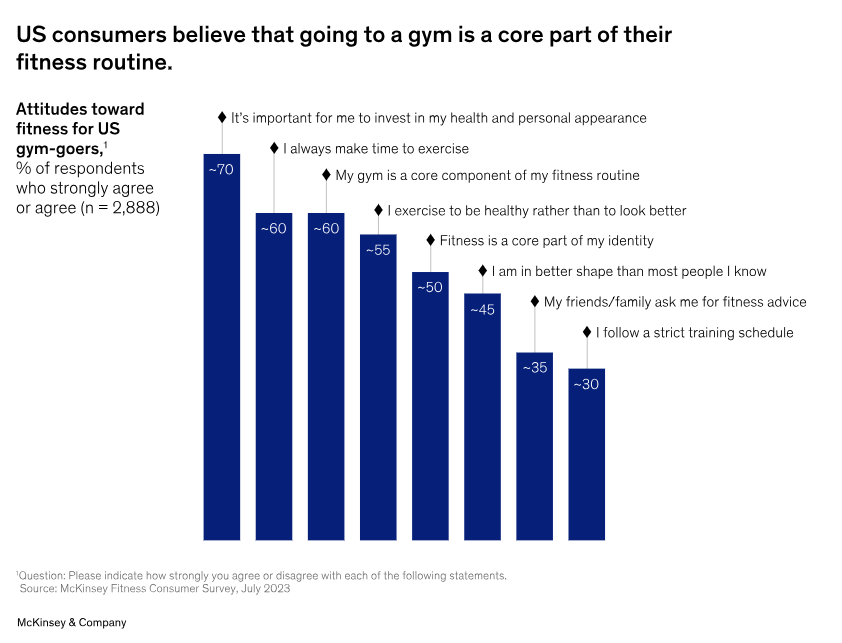

Weight management is a predominant concern, especially in the US, where 60% of consumers are trying to lose weight. While exercise remains the main strategy, medications such as GLP-1-based drugs are gaining ground. However, perceptions of these treatments vary between countries. - On-site fitness

For many, fitness is no longer a pastime, but a central part of their identity. The challenge for gyms is to maintain user loyalty by offering personalised experiences and relying on tools such as artificial intelligence to create unique training plans. - Gut health

More than 80% of consumers in China, the UK and the US consider gut health important, and this interest is expected to increase in the coming years. While probiotic supplements are popular, there is demand for more products that support this area. - Sexual health

Increased sex education and openness around sexuality has led to a growth in demand for sexual health products, especially for women. More and more retailers are expanding their offerings of such products, opening up opportunities for emerging brands. - Dream

Sleep remains a priority for consumers, but also an area with many unmet needs. Factors such as diet, stress and screen time complicate sleep improvement. Companies that succeed in addressing these issues with technological solutions could stand out in this market.

As consumers seek to take more control of their health, they are demanding products and services that are backed by data and are accessible. Companies that are able to deliver personalised, relevant and science-based solutions will be ideally positioned to succeed.